In May, the impasse over the debt ceiling between Democrats and Republicans created a bit of a stalemate in the markets, although the “happy ending” was still a foregone conclusion. The deal to raise the ceiling passed the House and Senate support seems likely. Nonetheless, the major stock indexes closed sharply higher, led especially by the upside potential of artificial intelligence-related stocks. In summary terms, growth stocks outperformed value (+4.54%, considering only stocks in the S&P 500), the Nasdaq index gained +7.7%, the S&P 500 +0.25% and Europe lost -3.24%.

In macroeconomic terms, as widely expected, the FED raised rates by 25 bps, bringing the terminal rate into the 5.00% to 5.25% range. During the conference, Powell said that the FOMC might be inclined to suspend future rate hikes, but not to cut in the immediate term. Nonetheless, the FED chairman confirmed that we are nearing the end of the monetary tightening cycle, although it will continue to be “data dependent.”

April U.S. inflation fell to 4.9% (5.0% surv. and 5.0% prior.) with the core figure excluding volatile food and energy prices increased by 5.5%, in line with expectations and lower than the March figure of 5.6%.

According to FactSet, companies in the S&P 500 reported the second consecutive quarter of declines with profit down – 2.1%, better than expected – about 6.5%.

In terms of employment, the U.S. labour market was still robust with better-than-expected numbers for new job creation (+253k vs. 185k surv.), a lower unemployment rate (3.4% vs. 3.6 surv.) and consistent wage growth (+0.5% vs. 0.3% surv.).

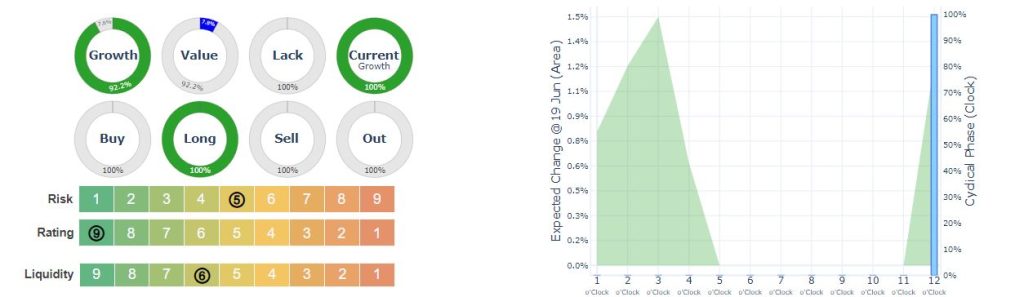

In operational terms, we continued to be averagely invested in the areas

Megatrends – Global Sector – Robotics – Building Products – Utilities – Banks – Diversified Financial – Food, Beverage & Tobacco – Hotels Restaurants & Leisure – Nasdaq Selection – Pharmaceuticals & Life Sciences, Media & Entertainment while our mathematical analysis and AI models led us to a Sell Out of the Materials line

We have also inserted for prudence a small hedge on the Nasdaq that is in addition to the one opened last month on the S&P500 hedges that give more stability to the NAV in this period of high volatility.

As always using our AI we try to balance sectors and investment timing always with a Long vision but conscious that all indicators show a worsening situation that could lead to a sharp Sell Off.

Overall, Our INDEX remains Growth with a Long view, high liquidity of the securities included in the portfolio, and active risk management.